The Kedungu Fund, managed by Kosong Satu Capital, a subsidiary of Kosong Satu Group, has a decade of experience in real estate investments in popular Indonesian destinations.

With a proven track record of identifying and investing in lucrative properties across Indonesia, our team brings a wealth of experience and expertise to the table.

We are committed to providing our investors with secure and reliable opportunities for profitable growth in the dynamic Indonesian real estate market.

10+ years experience in real-estate

Kosong Satu Group is a trusted and experienced property investment business since 2013, amongst other industries.

– 200+ hectares traded in Sumba

– 10+ years trading properties in Sumba

– Current assets ± 40 hectares

– Portfolio of 2 plots (Seseh and Pantai Lima)

– Development in conceptual phase

Traded numerous properties in Bali and East Indonesia for the last 10 years

Advantages of Investing in the Fund

01. Low Barrier to Entry

The Fund is available to any investor, large or small. For retail investors who have limited capital to invest, the Fund is a great way to get exposure to the real estate market and earn passive investment returns.

02. Portfolio Diversification

Investing in any type of Funds will almost ensure the investor of having a diversified investment portfolio of real estate assets.

03. Return Potential

Like other types of real estate investments, the Fund has the potential to see capital appreciation over time and to generate returns for shareholders. Scalability is much more achievable compliments to the volume of assets.

04. Dividend Payments

Funds tend to have high dividend yields compared to other types of investments.

05. Passive Income

Importantly, limited partners are able to earn passive income on their investment. This means that after making the initial investment, the investor does not need to do anything else to earn a return on their capital. Real estate offers many ways to make money, but many are very time consuming, like land hunting or development. The Fund eliminates the need for the investor to manage the properties they own, hire property management firms, and deal with contractors, tenants, and leases.

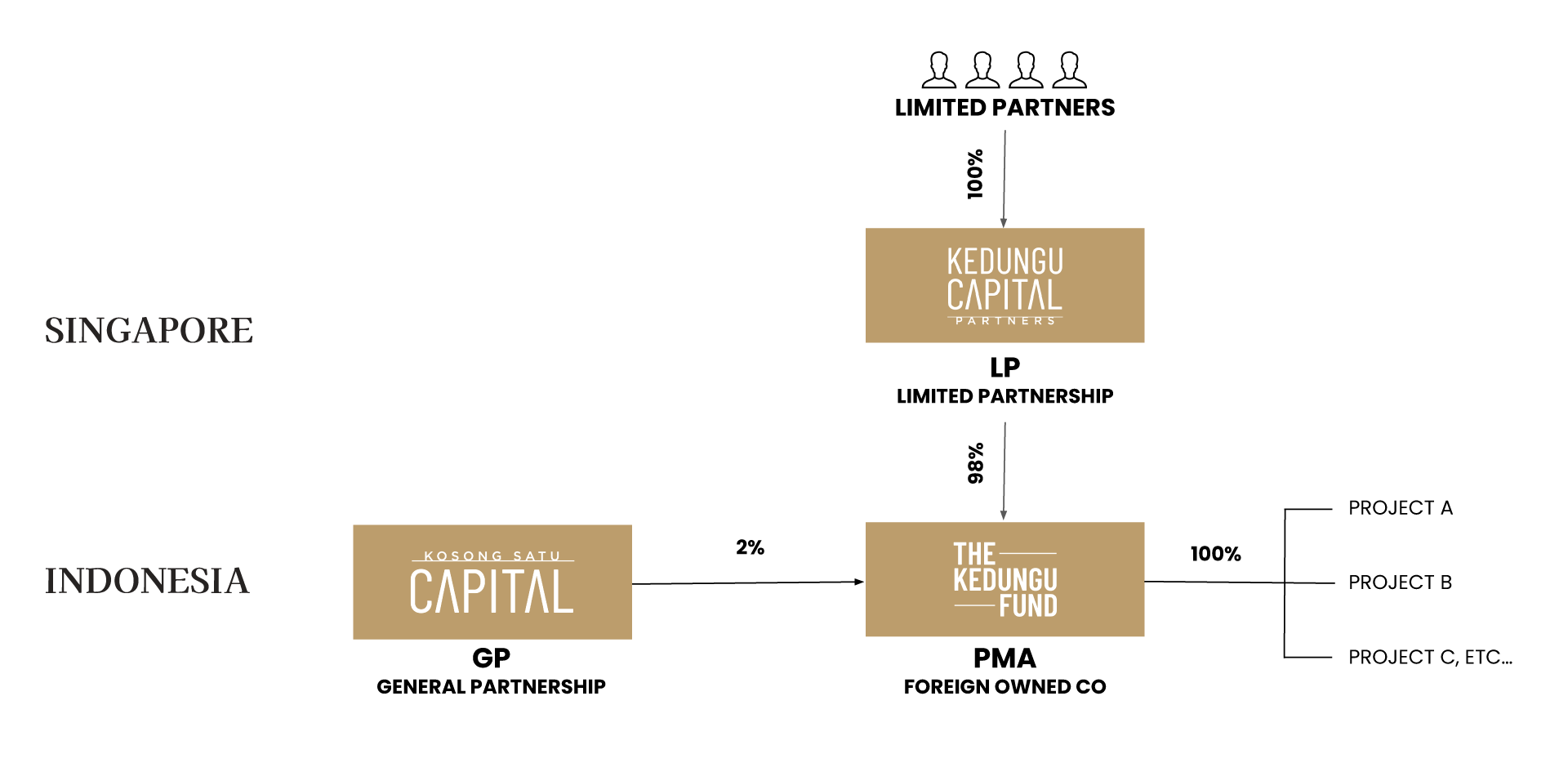

Fund Structure

We have chosen to implement a streamlined structure in order to effectively manage expenses and expedite the initiation of operations. Furthermore, the utilization of a more conventional Real Estate Investment Trust (REIT) approach, whether in Indonesia or Singapore, does not permit the acquisition of undeveloped land or properties

construction.

To accommodate new investors, the fund will periodically issue additional shares. The legal process of equity ownership can also be completed remotely for added convenience.

Fund Fees & Carried Interests Structure

Contact Us

Omri Ben-Canaan

WhatsApp

Email